19

O

ur indebtedness grew by 10% in 2014. This is

partly due to our shale gas drilling pipe plant

investment, which will begin production this year

in Texas. It is also the result of our investments

in energy business and rental fleet for our

distributorship businesses, which we made with

compatible ratios in the market, requiring less capital and greater

bank borrowing. However, we managed our foreign exchange

risks successfully despite devaluations in two important countries

where we operate.

While we maintained accustomed growth tempo in 2015, we still

aim to significantly increase our profitability. We plan to achieve

this through structural changes to our business processes,

which we initiated in 2014, and by employing new strategies

to increase customer centricity, especially in our logistics and

construction equipment distributorship businesses, and by

developing new approaches to meeting customer needs in all of

our businesses.

In 2014, while celebrating our 70th anniversary, we established

our targets for 2019 under the 5-year strategic plan we apply to

build our future.

e created Borusan’s portfolio vision and

strategy by considering those customer

segments and types of business that offer

an attractiveness to us, while unaffiliated

with the sectors our Group companies are

currently doing business in. Accordingly, we

shall place even greater importance and emphasis than usual

on expanding the businesses that have come to stand out and

attained success in two of the following basic categories in our

Group portfolio. The first encompasses businesses that offer

integrated, intellectually driven and engineering based products,

services and solutions. The second involves businesses that

create “market platforms” in which business communities’ needs

are served in a fast, simple and low cost basis via the use of

technology and market optimization.

In recent years, Borusan

Group has started prioritizing

actions that ensure progress

in this direction in nearly all of

business units. In addition to

our strategic investments and

the fast and decisive steps

on new product development

and innovation that we have

taken since 2012, we have

begun to act on organizational

development. This is a most

fundamental priority for

creating a corporate climate

that is more customer-oriented,

leaner and more agile as we

approach 2019.

In order to create a successful

and responsible conglomerate

with growing, highly profitable

and innovative businesses that

dominate their markets, and a

culture where the best talent

can excel by 2024, Borusan

Group’s 80th anniversary,

we will maintain our efforts in

2015, the first year of this new

era, with the contribution of all

of our stakeholders.

I extend my sincere

appreciation to all our

shareholders, customers and

employees, who have made us

what we are today.

Sincerely,

Agah Uğur

Group CEO

Borusan Holding

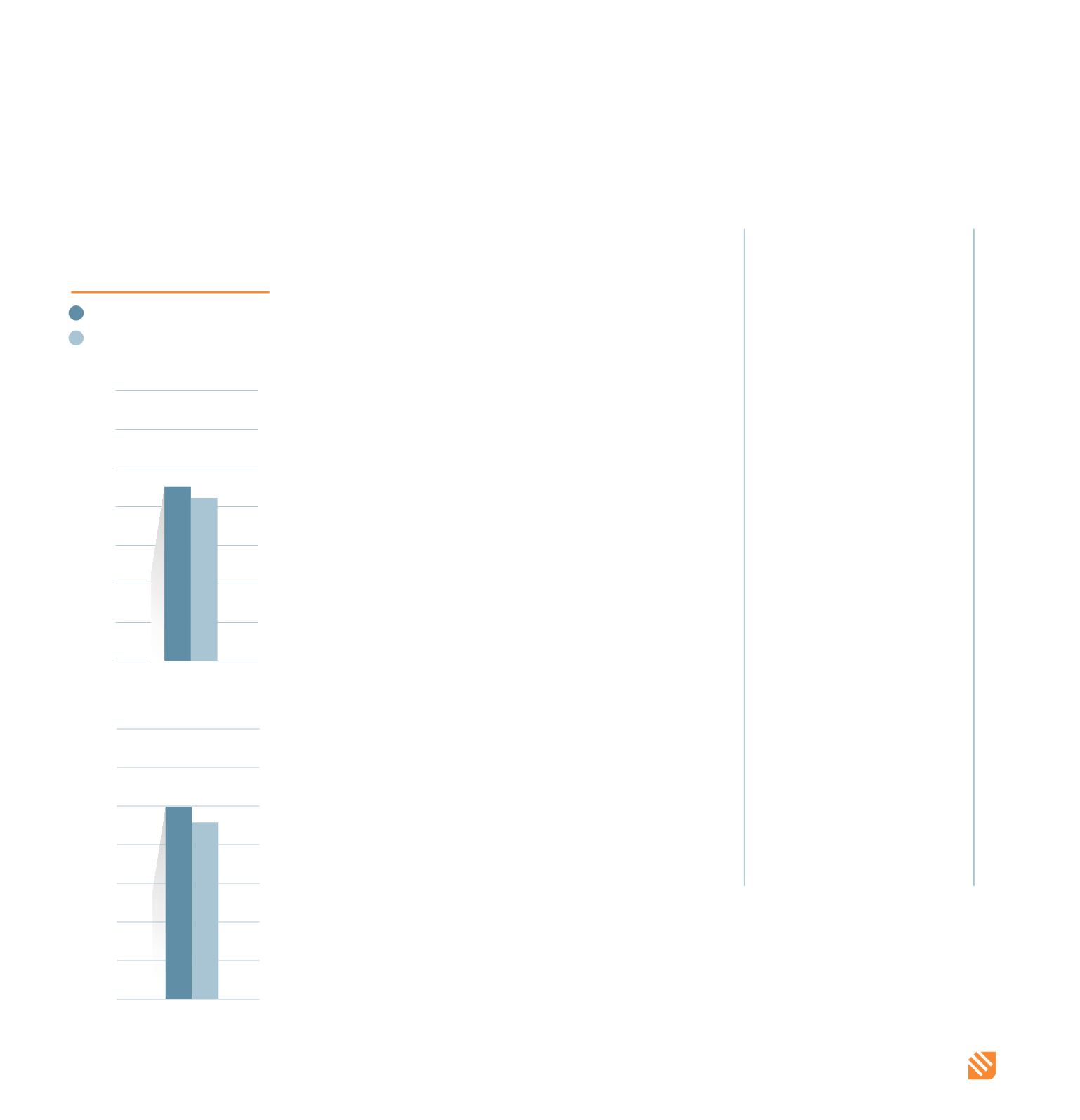

200

400

600

800

1000

1200

1400

1600

2013

1,091

1,058

200

400

600

800

1000

1200

1400

1600

2014

1,198

1,164

Consolidated Working Capital

and Net Financial Debt

(US$ Millions)

Consolidated Working Capital

Net Financial Debt

W