149

33. DERIVATIVE FINANCIAL INSTRUMENTS

(continued)

Interest Rate Swaps

Under interest rate swap contracts, the Group agrees to exchange the difference between fixed and floating rate interest amounts calculated on agreed notional principal amounts. Such

contracts enable the Group to mitigate the risk of changing interest rates on the fair value of issued fixed rate debt and the cash flow exposures on the issued variable rate debt. The fair

value of interest rate swaps at the end of the reporting period is determined by discounting the future cash flows using the curves at the end of the reporting period and the credit risk

inherent in the contract, and is disclosed below. The average interest rate is based on the outstanding balances at the end of the reporting period.

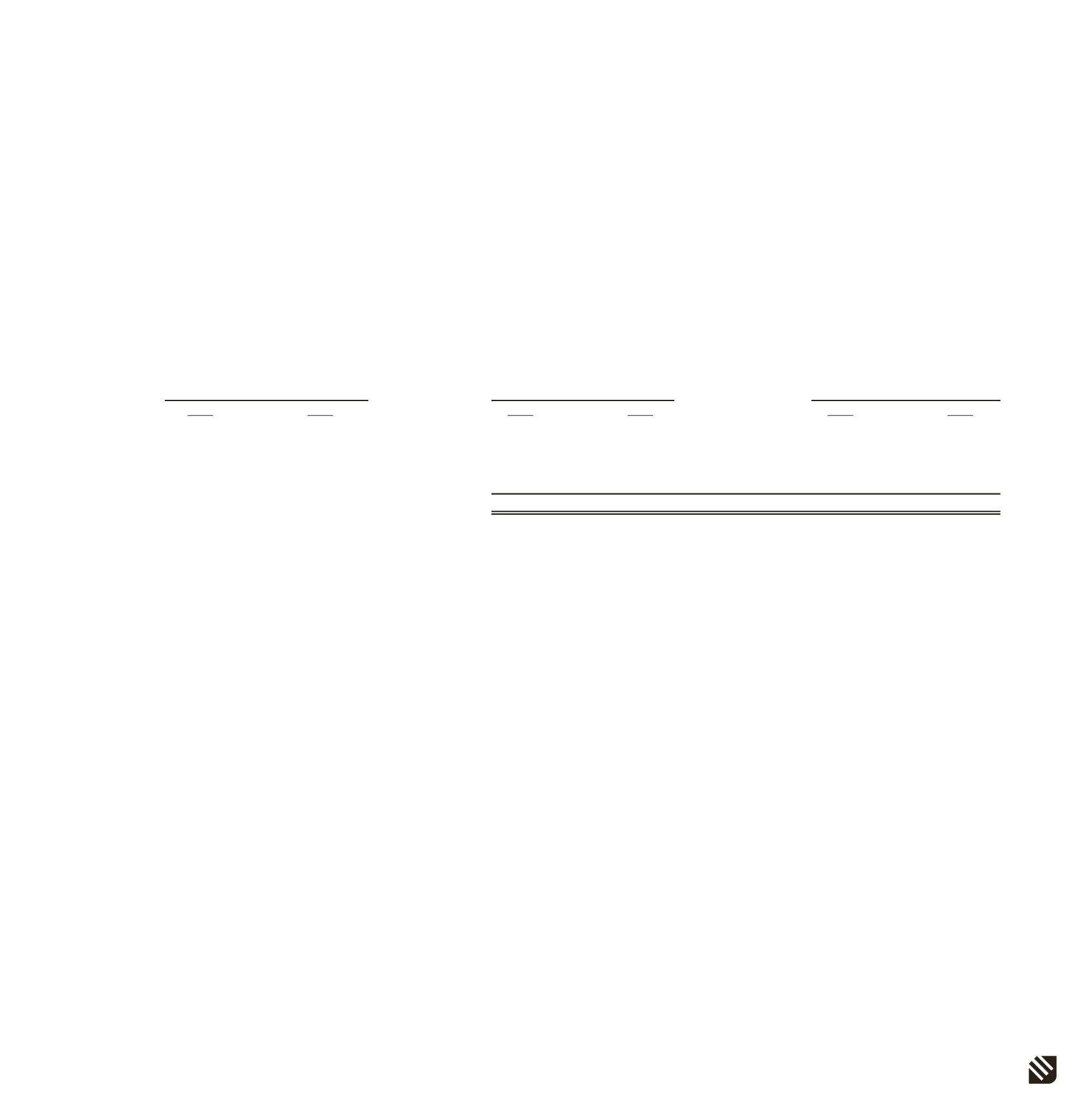

The following tables detail the notional principal amounts and remaining terms of interest rate swap contracts outstanding at the end of the reporting period.

Average contracted fixed interest rate Notional principal value

Fair value assets (liabilities)

2014

2013

2014

2013

2014

2013

%

%

Less than 1 year

2.80

-

44,642,857

-

172,076

-

1 to 2 years

2.80

2.75

18,071,429

10,860,000

-

(267,502)

2 to 5 years

2.79

-

2,857,143

-

-

-

65,571,429

10,860,000

172,076

(267,502)

BORUSAN HOLDING A.Ş. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014

(Currency - US Dollars (“USD”) unless otherwise indicated)