31. FINANCIAL RISK MANAGEMENT

(a) Capital risk management

Capital risk management of the Group aims to maximize the profitability through the optimization of the debt and equity balance, while maintaining the continuity of its business

operations.

The capital structure of the Group includes of issued capital, reserves and equity items consisting of retained earnings disclosed in Notes 19 and 20, respectively.

The Group’s cost of capital and capital risks associated with each capital item are assessed by the Board of Directors and the Management of the Holding. Decisions on the dividend

payments or capital increase are made based on those assessments and the Holding aims at balancing its capital structure by borrowing loans or settling its debt amounts.

The Group’s overall strategy is determined in accordance with the financial risk management application framework issued on 22 October 2010.

(b) Significant accounting policies

The details of the Group’s significant accounting policies in respect of financial instruments are disclosed in Note 3 “Summary of significant accounting policies” to the financial

statements.

The carrying value of the financial instruments listed above approximates their fair values as of 31 December 2014.

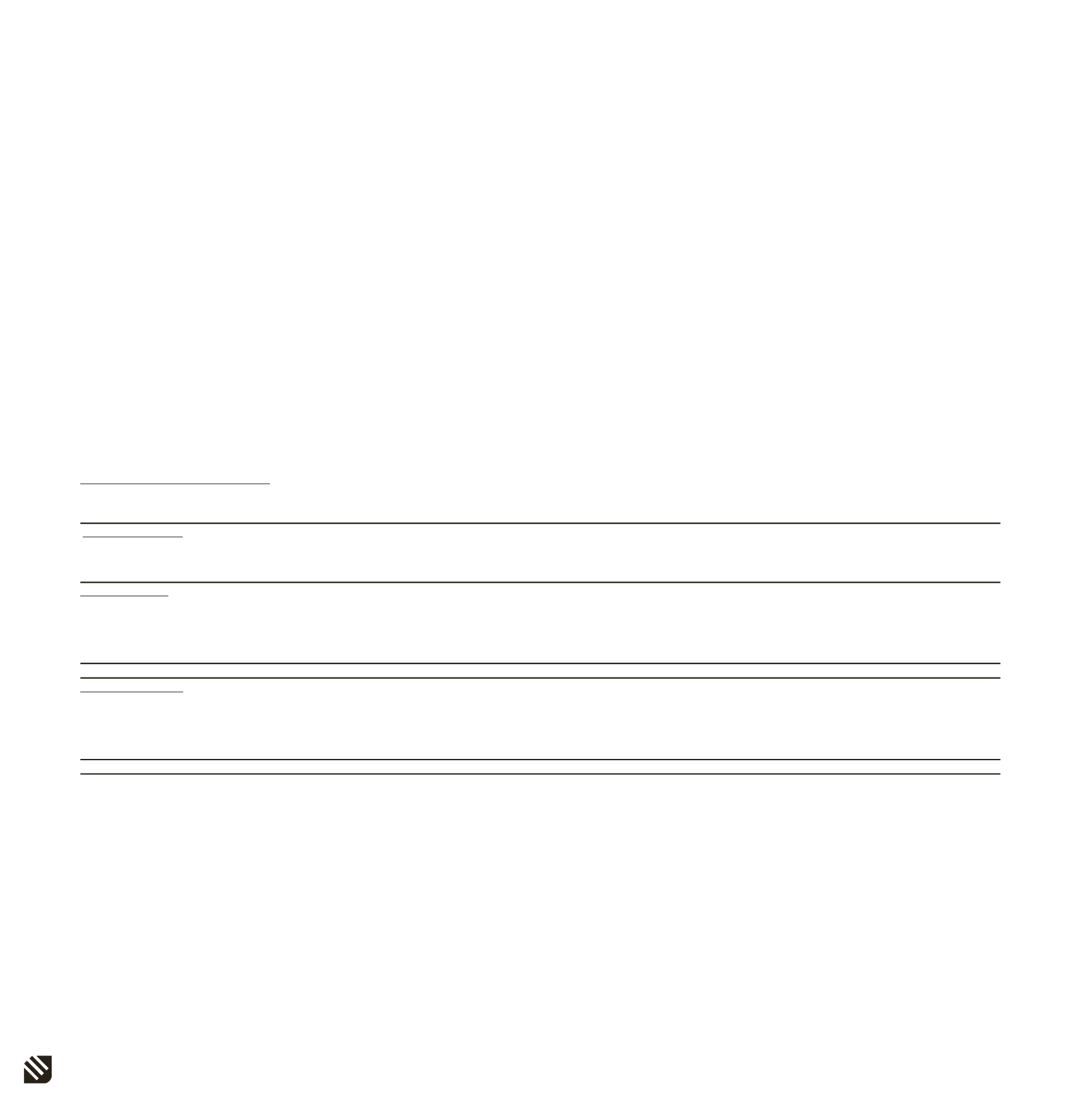

Categories of financial instruments

Financial Assets

Cash and cash equivalents

445,437,890

-

-

-

445,437,890

6

Trade receivables

524,589,777

-

-

-

524,589,777

7

Other assets

154,146,336

-

-

-

154,146,336

9

Available for sale investments

-

4,160,262

-

-

4,160,262

1,124,174,003

4,160,262

-

-

1,128,334,265

Financial Liabilities

Borrowings

-

-

1,609,379,113

- 1,609,379,113

14, 15

Trade payables

-

-

752,975,276

-

752,975,276

13

Other payables

-

-

6,022,970

-

6,022,970

16

Derivative financial liabilities

-

-

-

616,534

616,534

16

-

-

2,368,377,359

616,534

2,368,993,893

Note

31 December 2014

Balance Sheet

Loans and receivables

(including cash and

cash equivalents)

Available for

sale investments

Financial liabilities at

amortized cost

Derivative financial

instruments

Total

BORUSAN HOLDING A.Ş. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014

(Currency - US Dollars (“USD”) unless otherwise indicated)