147

31. FINANCIAL RISK MANAGEMENT

(continued)

Fair value of financial instruments

The fair values of financial assets and financial liabilities are determined and grouped as follows:

•Level 1: the fair value of financial assets and financial liabilities with standard terms and conditions and traded on active liquid markets are determined with reference to quoted market

prices;

•Level 2: the fair value of other financial assets and financial liabilities (excluding derivative instruments) are determined in accordance with generally accepted pricing models based on

discounted cash flow analysis using prices from observable current market transactions; and

• Level 3: the fair value of the financial assets and financial liabilities where there is no observable market data. The fair value of derivative instruments, are calculated using quoted

prices. Where such prices are not available, estimate is made based on discounted cash flow analysis using the applicable yield curve for the duration of the instruments for non-optional

derivatives, and option pricing models for optional derivatives.

Based on the fair value hierarchy, the Group’s financial assets and liabilities are categorized as follow:

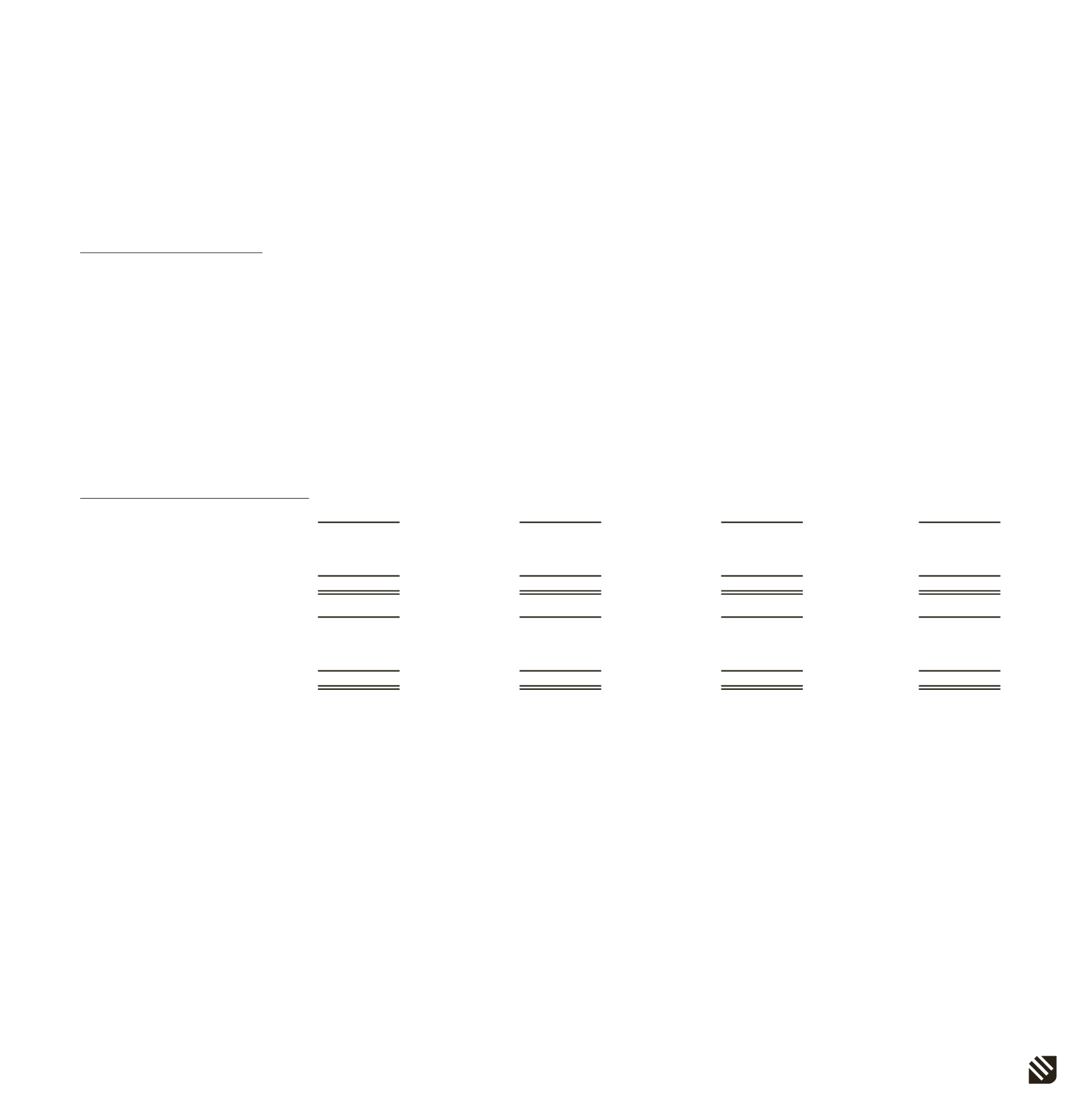

Financial Assets - Fair Value Measurement

2014

Level 1

Level 2

Level 3

Total

Financial assets at FVTPL

Investment funds

9,605,717

-

-

9,605,717

Derivative transactions (net)

-

(616,534)

-

(616,534)

9,605,717

(616,534)

-

8,989,183

2013

Level 1

Level 2

Level 3

Total

Financial assets at FVTPL

Investment funds

3,428,624

-

-

3,428,624

Derivative transactions (net)

-

(2,736,550)

-

(2,736,550)

3,428,624

(2,736,550)

-

692,074

BORUSAN HOLDING A.Ş. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014

(Currency - US Dollars (“USD”) unless otherwise indicated)