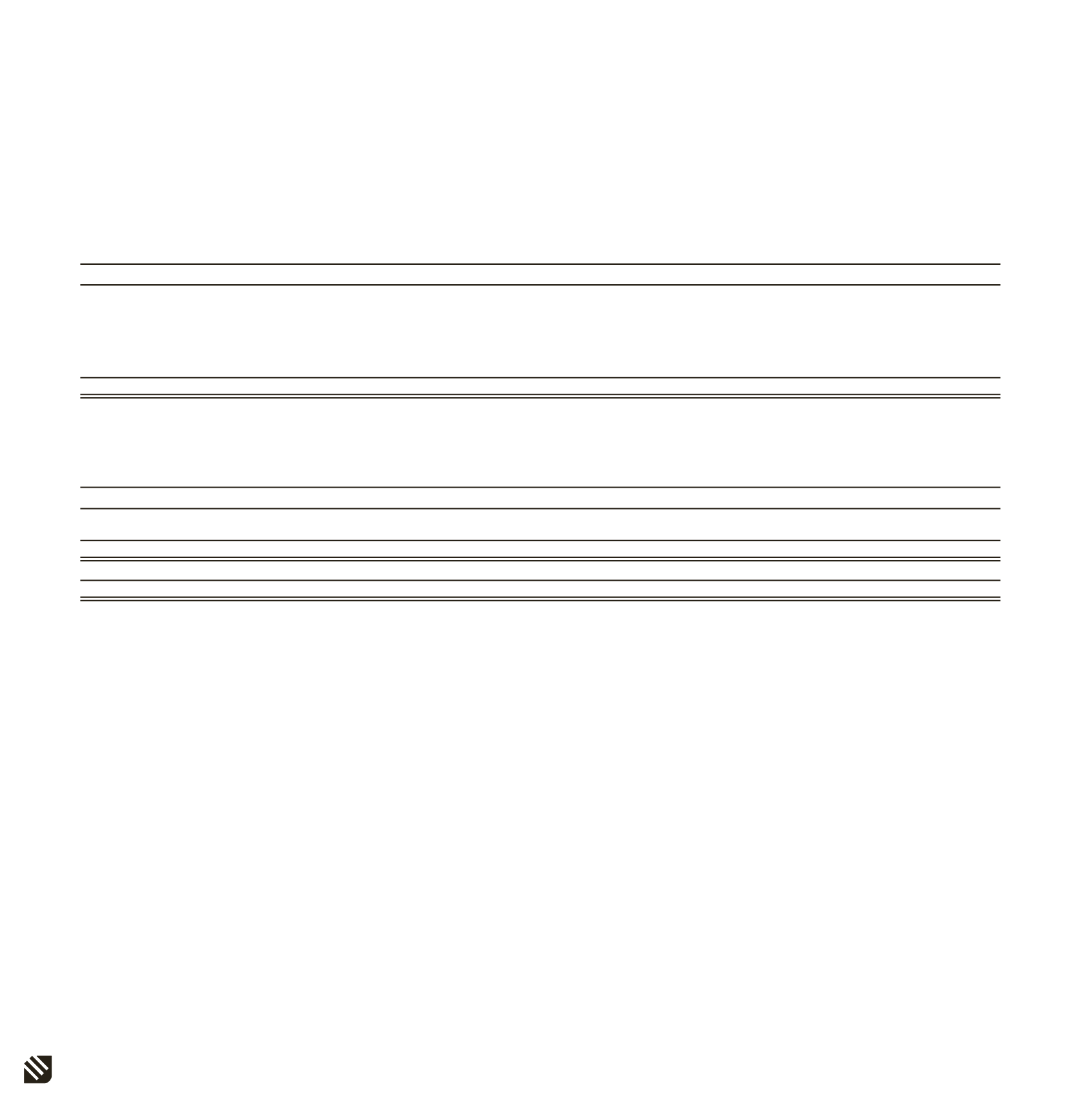

18. EMPLOYEE BENEFITS OBLIGATION

(continued)

2014

2013

Beginning of the year

25,048,231

28,427,376

Actuarial (gain) / loss

(293,425)

1,335,338

Interest expense

1,078,625

1,255,459

Current service cost

5,194,273

3,303,937

Payments

(4,761,500)

(6,014,123)

Currency translation reserve

(2,124,847)

(3,259,756)

End of the year

24,141,357

25,048,231

2014

2013

Actuarial (gain)/ loss

3,144,192

3,437,617

Deferred tax

(628,839)

(687,524)

Actuarial (gain)/ loss (Net)

2,515,353

2,750,093

Non controlling interest

(999,964)

(1,147,773)

Actuarial (gain)/ loss attributable to equity holders' of the parent

1,515,389

1,602,320

Equity reconciliation of actuarial gains and losses from employee benefits obligation is as follows:

Of the total charge of provision for employee benefits obligations, USD 2,362,927 is charged to cost of sales, (2013: USD 809,237 is credited) and USD 3,909,971 (2013: USD 4,289,103)

is charged to marketing and general administrative expenses.

Average number of personnel for the year ended 31 December 2014 was 6,706 (2013: 6,321). During the year ended 31 December 2014, the average number of personnel working

abroad was 1,100 (2013: 955), of which 786 (2013: 760) are located in Middle East and Central Asia, 2 (2013: 2) in the United Kingdom, 90 (2013: 90) in Italy, 35 (2013: 34) in North Africa,

20 (2013: 27) in Malta, 11 (2013: 12) in Cyprus, 156 (2013: 30) in USA.

BORUSAN HOLDING A.Ş. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014

(Currency - US Dollars (“USD”) unless otherwise indicated)